10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 28, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

||

The |

Securities registered pursuant to Section 12(g) of the Act: Warrants to purchase Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes □

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ |

Accelerated filer |

☐ |

|

|

|

|

|

Non-accelerated filer |

☐ |

Smaller reporting company |

|

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2022 was $

As of February 17, 2023, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2023 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2022.

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

References to the “Company,” “Cryoport,” “we,” “us,” “our” and other similar words refer to Cryoport Inc. and its consolidated subsidiaries, unless the context suggests otherwise. This Annual Report on Form 10-K (this “Form 10-K”) contains certain forward-looking statements. These forward-looking statements involve a number of risks and uncertainties. These forward-looking statements can generally be identified as such because the context of the statement will include certain words, including but not limited to, “believes,” “may,” “will,” “expects,” “intends,” “estimates,” “anticipates,” “plans,” “seeks,” “continues,” “predicts,” “potential,” “likely,” or “opportunity,” and also contains predictions, estimates and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on the current beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Readers of this Form 10-K should not put undue reliance on these forward-looking statements, which speak only as of the time this Form 10-K was filed with the Securities and Exchange Commission (the “SEC”). Reference is made in particular to forward-looking statements regarding our expectations about future business plans, new products or services, regulatory approvals, strategies, development timelines, prospective financial performance and opportunities, including potential acquisitions; expectations about future benefits of our acquisitions and our ability to successfully integrate those businesses and our plans related thereto; liquidity and capital resources; projected trends in the market in which we operate;; expectations relating to current supply chain impacts; inflationary pressures and the effects of foreign currency fluctuations; expectations relating to the impacts on our operations resulting from the ongoing war between Russia and Ukraine; anticipated regulatory filings or approvals with respect to the products of our clients; expectations about securing and maintaining strategic relationships with global couriers or large clinical research organizations; our future capital needs and ability to raise capital on favorable terms or at all; results of our research and development efforts; and approval of our patent applications. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. The Company’s actual results may differ materially from the results projected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in this Form 10-K, including the “Risk Factors” in “Part I, Item 1A — Risk Factors” and in “Part II, Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as those discussed in reports filed with the SEC after the date of this Form 10-K.

Past financial or operating performance is not necessarily a reliable indicator of future performance, and you should not use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Except as required by law, we do not undertake to update any such forward-looking statements and expressly disclaim any duty to update the information contained in this Form 10-K.

3

PART I

Item 1. Business

Overview

Cryoport is a global leader serving the life sciences industry as a provider of integrated temperature-controlled supply chain solutions supporting the life sciences in the biopharma/pharma, animal health, and reproductive medicine markets. Our mission is to support life and health worldwide through comprehensive, innovative, and highly differentiated temperature-controlled solutions, including apheresis collection and cryoprocessing, global logistics, technologically sophisticated packaging, biostorage and bio-services, informatics, and cryogenic systems for regenerative medicine, cellular therapies, and life science products and treatments that require unique, specialized temperature-controlled management.

With 48 strategic international locations, Cryoport’s global platform provides mission-critical solutions to over 3,000 customers working in biopharma/pharma, animal health, and reproductive medicine companies, universities, research institutions, and government agencies. Our platform of solutions and services together with our global team of over 1,000 dedicated colleagues delivers a unique combination of innovative supply chain technologies and services through our industry-leading brands, including Cryoport Systems, IntegriCellTM, CryoStork®, MVE Biological Solutions, CRYOPDP, and CRYOGENE.

Cryoport’s advanced temperature-controlled supply chain platform is designed to support the global distribution of high-value commercial biologic and cell-based products and therapies regulated by the United States Food and Drug Administration (FDA), the European Medicines Association (EMA) and other international regulatory bodies. Cryoport’s solutions are also relied upon for the support of pre-clinical, clinical trials, Investigational New Drug Applications (IND), Biologics License Applications (BLA), and New Drug Applications (NDA) with the FDA, as well as global clinical trials initiated in other geographies, where strict regulatory compliance and quality assurance is mandated.

Over the last several years, we have grown to become a leader in supporting the clinical trials and commercial launches of cell and gene therapies globally. As of December 31, 2022, we supported 654 clinical trials, of which 79 were in Phase 3, and ten (10) commercial therapies. We believe regenerative medicine advanced therapies that successfully advance through the clinical trial process and receive commercial approval from the respective regulatory agencies will represent opportunities to become significant revenue drivers for us as the majority of them will require comprehensive temperature-controlled supply chain support and other services at commercial scale. Additionally, we expect that most will select us as their critical supply chain solution partner as a result of our work in connection with their respective clinical trials and our long track record of innovation and market responsiveness.

In addition, Cryoport also supports the animal health market and the human reproductive market on a global basis with its advanced supply chain platform. The animal health market is mainly composed of supporting animal husbandry, as well as companion and recreation animal health. The human reproductive market is largely composed of In-Vitro Fertilization (IVF) support for patients and clinics.

Cryoport’s mission is to enable the life sciences to save and improve lives around the world by providing certainty throughout the temperature-controlled supply chain. Our people, innovative solutions, and industry leading technologies have been designed to exceed current standards to deliver certainty and de-risk the process across the entire temperature-controlled supply chain for the life sciences.

The Markets We Serve

Cryoport serves the life sciences industry as a trusted provider of integrated temperature-controlled supply chain solutions supporting the biopharma/pharma, animal health, and reproductive medicine markets.

4

Biopharma/Pharma. In the biopharma/pharma market, we are focused on supporting biopharma/pharma companies, primarily, in the saving of lives. From clinical research and development to clinical research organizations, to clinical trials for cell and gene therapies, to the storage and delivery of life-saving commercial cell and gene therapies, to the customers of biopharmaceutical /pharmaceutical organizations, to crucial points of care, we strive to address fundamental to advanced temperature-controlled storage, transport, packaging, fulfillment, and information challenges. Cell and gene therapies have become a rapidly growing area of biological drug development, with over $12 billion in funding raised in 2022. There were 1,457 cell and gene therapy developers worldwide, as reported by the Alliance for Regenerative Medicine (ARM) in its State of the Industry Briefing published on January 9, 2023. These developers have certain supply chain challenges that we believe our solutions are well tailored to address.

| ● | Cell Therapies. As per ARM, cell therapy is “the administration of viable, often purified cells into a patient’s body to grow, replace, or repair damaged tissue for the treatment of a disease. Cell therapies may be autologous, meaning that the patient receives cells from their own body, or they may be allogeneic, meaning the patient receives cells from a donor. Allogeneic cell therapies are often referred to as off-the-shelf therapies, as they are derived from a donor who is not the patient, enabling advance preparation and available to the patient immediately at the time of need.” |

| ● | Gene Therapies. As per ARM, “gene therapy seeks to modify or introduce genes into a patient’s body with the goal of durably treating, preventing, or potentially even curing disease, including several types of cancer, viral diseases, and inherited disorders.” |

Animal Health. In the animal health market, we provide support for animal reproduction, which primarily involves the production of protein. We also support medicine for the health of recreational and companion animals. Animal disease prevention and control rely on the safe transport and storage of vaccines and other biological materials around the world. Our secure temperature-controlled supply chain solutions are designed to help avoid costly delays through nonstop monitoring and complete fleet management from and to the origin and destination points as well as provide cryobiological storage equipment.

Reproductive Medicine. In the human reproductive medicine market, we are focused on supporting the creation of human life. This is primarily accomplished by supporting IVF, and related technologies, along with fertility networks globally. IVF materials receive one-on-one handling and individualized attention during the entire logistics process.

Acquisitions

We have further extended our solutions, capabilities, and global logistics network through the following acquisitions:

| ● | In May 2019, we acquired Cryogene Labs (CRYOGENE), which is today an expanding state-of-the-art temperature-controlled biostorage solutions business strategically located in Houston, Texas. CRYOGENE is an industry leader in the management of pre-clinical and clinical biostorage services, including critical biological commodities supporting clinical research, the advancement of cell and gene therapy, and public health research. It provides customized, end-to-end chain of custody/chain of condition solutions for its clients. CRYOGENE’s GMP (good manufacturing practices) operation is an FDA audited operation serving all temperature categories of the temperature-controlled supply chain for the life sciences. |

| ● | In October 2020, we acquired CRYOPDP, a leading global provider of innovative temperature-controlled logistics solutions for high value, time critical and temperature-sensitive biopharmaceutical/pharmaceuticals. CRYOPDP provides the biopharma market with temperature-controlled logistics, including packaging, pick-pack kit preparation, premium services, and specialty biopharma/pharma courier support. At the time of acquisition, CRYOPDP added a network of 22 global logistics centers located in 12 countries to our global network. These additions expanded our logistics network to provide “last mile” services and to better serve our global multi-national clients. They also added redundancies and backup that reduced supply chain risk for our clients. |

5

| ● | In October 2020, we also acquired MVE Biological Solutions (MVE), the global leader providing cryobiological storage and transportation systems for the life sciences industry through its advanced line of cryogenic systems including stainless-steel freezers, aluminum dewars and related ancillary equipment used in the storage and/or transport of life sciences commodities. MVE’s three primary manufacturing facilities which are located in Ball Ground, GA, New Prague, MN and Chengdu, China. The acquisition was a vertical integration that, in addition to expanding our footprint to handle the growing demand driven by the growth in the cell and gene therapy market, was intended to further secure our supply of cryogenic systems. MVE’s clients include cell and gene therapy, medical laboratories, biotech/pharmaceutical research facilities, blood and tissue banks, animal breeders, academic institutions, veterinary laboratories, large-scale biorepositories, fertility clinics, government agencies, and other institutions. |

| ● | In April 2021 and May 2021, we acquired Critical Transport Solutions Australia (CTSA) in Australia and F-airGate in Belgium, respectively, to further enhance CRYOPDP’s existing global temperature-controlled logistics capabilities in the APAC and EMEA regions. |

| ● | In April 2022, we acquired Cell&Co BioServices in Clermont-Ferrand, France with additional operations in Pont-du-Château, France to further enhance our existing global temperature-controlled supply chain capabilities. Cell&Co BioServices is a bioservices business providing biorepository, kitting, and logistics services to the life sciences industry and now a part of Cryoport Systems’ Global Supply Chain Center Network. |

| ● | In July 2022, we acquired Polar Expres based in Madrid, Spain, which provides temperature-controlled logistics solutions dedicated to the life sciences industry. Polar Expres operates logistics centers in Madrid and Barcelona supporting the rapidly growing life sciences market. This acquisition further expanded CRYOPDP’s footprint in the EMEA region. |

| ● | In July 2022, we also acquired Cell Matters based in Liège, Belgium, a company with cryobiology expertise, providing cryo-process optimization, cryoprocessing, and cryopreservation solutions to the life sciences industry. This acquisition is tied to Cryoport Systems’ new initiative to establish standardized, integrated apheresis collection, processing, biostorage, and distribution solutions for cellular therapies. The new platform will leverage the cryo-processing expertise of Cell Matters (rebranded IntegriCell™) to provide consistent, high-quality cellular starting material for use in the manufacture of life-saving cellular therapies. |

6

Cryoport Products and Services

We continuously expand our products and services across the supply chain with innovative, technology-centric solutions to support the development and distribution of life sciences products and therapies.

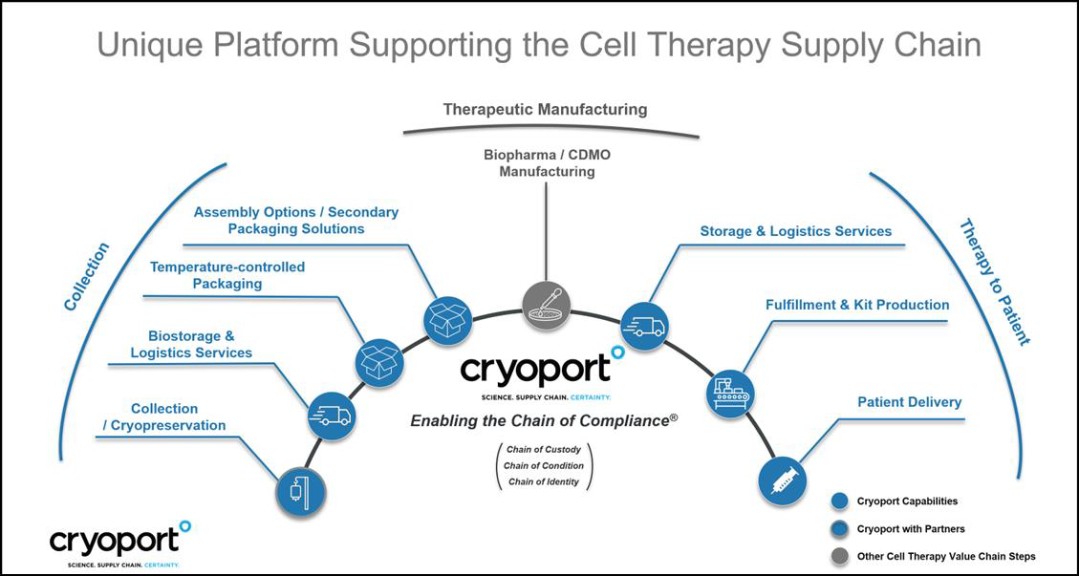

Figure 1: Cryoport’s products and services supporting cell therapy development and distribution.

Our suite of market leading products and services include, but are not limited to the following:

Cryoport Express® Shippers - Cryoport Express® Shippers range from liquid nitrogen dry vapor shippers (-150℃) to our C3™ Shippers (2-8℃), which are powered by phase-change materials. The Cryoport Express® Shippers are precision-engineered assemblies that are reliable, cost-effective, and reusable or recyclable. Our liquid nitrogen dry vapor Cryoport Express® Shippers utilize an innovative application of ‘dry vapor’ liquid nitrogen technology and, most often, include a SmartPak™ Condition Monitoring System. Cryoport Express® Shippers meet IATA requirements for transport, including Class 6.2 infectious substances, are also ISTA “Transit Tested” certified and carry the CE (“Conformité Européenne”) mark demonstrating conformance with European Union (“EU”) health, safety, and environmental protection standards.

Cryoport ELITE™ Shipper Systems

| ● | Cryoport ELITE™ -80°C Gene Therapy Shipper - As the first product in a high-performance line of Cryoport ELITE™ Shippers, the company has designed a best-in-class family of -80°C shippers that have superior temperature management properties as well as incorporate next generation protection, handling, and data collection and management systems including our SmartPak™ Condition Monitoring System. The Cryoport ELITE™ shipper line has been developed in conjunction with one of the leaders in the gene therapy space for clinical and commercial gene therapy distribution. The ELITE™ shipper platform will be launched during the first quarter of 2023. |

7

| ● | Cryoport ELITE™ Cryosphere™ Shipper - The second product in the new high-performance line of Cryoport ELITE™ Shippers is the Cryosphere™, which is a revolutionary gravitationally stabilized shipper that is the most advanced cryogenic shipper to support the cell and gene therapy and other life sciences markets. This shipper is designed to passively stabilize the payload through an internal gravitational sphere, thereby keeping the payload in an upright orientation regardless of the external shipper orientation. This innovative technology further mitigates one of the key risks during storage, handling, and transport, which is maintaining constant cryogenic temperatures. In addition, the Cryosphere™ has advanced shock and vibration absorption properties to further protect its payload and it will be outfitted with Cryoport’s state-of-the-art condition monitoring systems. It has also been designed to be ergonomically friendly for our manufacturing and clinical partners providing a better user experience than other products in the market. The Cryosphere™ is expected to be launched during the second quarter of 2023. |

Cryoport Consulting Services – Cryoport Consulting Services functions in an expert advisory capacity to offer solutions to address risk factors present in temperature-controlled supply chain and logistics. To develop tailored scalable solutions, our cross-functional team collaborates with our clients to understand supply chain, logistics, time, shipper, and packaging concerns. Cryoport Consulting Services employs a structured approach to managing, executing, and developing risk mitigation plans. Our clients benefit from our quality driven processes and solutions delivered by our high integrity team leveraging industry-standard best practices and years of experience partnering with leading regenerative medicine companies from early clinical through post-commercialization. Service solutions range from comprehensive physical, thermal and shipping qualifications of shipping systems and/or packaging to developing user-friendly custom packaging solutions focused on the challenges unique to our regenerative medicine customers. Through our Packaging Center of Excellence we serve our clients in biopharma/pharma, animal health, and reproductive medicine markets by providing state-of-the-art customized packaging, testing, qualification capabilities and a host of other services.

Cryoport Bioservices – In June 2022, Cryoport Systems launched its first two Global Supply Chain Centers in Houston, Texas and Morris Plains, New Jersey. These state-of-the-art facilities combine our existing logistics processes and capabilities with our new, cutting edge Bioservices infrastructure – all under one roof, as Cryoport Systems’ Global Supply Chain Center Network. These new Cryoport Systems’ Global Supply Chain Centers offer a new and fully integrated approach designed to support cell and gene therapies including comprehensive controlled temperature storage, fulfilment, kit production, secondary packaging, labelling of therapeutic products and GMP raw materials storage along with advanced world class logistics. In April 2022, we acquired Cell&Co BioServices in Clermont-Ferrand, France with additional bioservices operations in Pont-du-Château, France to accelerate the setup of our bioservices capabilities in the EMEA region. Further expansion of the Cryoport Systems’ Global Supply Chain Center Network is expected to include additional sites in the Americas, EMEA and APAC regions. The addition of these facilities and services provides for our clients’ increasing need for comprehensive and integrated solutions offerings and the expected growth in the global biostorage and bioservices markets, which are driven by the acceleration of clinical trials and the commercialization of regenerative medicine therapies on a global basis.

CRYOGENE - provides unparalleled solutions for the provision of pre-clinical temperature-controlled biological materials management services to the life sciences industry. These services include comprehensive specimen storage, processing, collection, and retrieval at our recently expanded CRYOGENE operations in Houston, Texas, which is a cGMP-compliant operation. CRYOGENE is currently in the planning stage to expand its operations to San Antonio, Texas and Philadelphia, Pennsylvania.

CRYOPDP Temperature-controlled Logistics - CRYOPDP is a specialist providing global and innovative temperature-controlled logistics solutions to the biopharmaceutical/pharmaceuticals industry. CRYOPDP operates with expertise an exhaustive range of temperature-controlled logistics services including temperature-controlled packaging and premium transport solutions from cryogenic temperature (-196°C to -150°C) to controlled ambient (+15°C to +25°C).

IntegriCellTM Services – in conjunction with our recent acquisition of Cell Matters in July of 2022, Cryoport has launched its IntegriCellTM service platform. The IntegriCellTM platform is designed as a first-to-market, fully standardized apheresis collection and cryo-processing platform that is expected to be built out on a global basis. The platform services include apheresis/leukapheresis collection, CryoshuttleTM transportation services, cryo-process optimization, cryo-processing services, and biostorage to provide a more consistent starting product and increased patient accessibility into the community care setting for regenerative medicine therapies.

MVE Biological Solutions

| ● | MVE Biological Solutions’ Fusion® Cryogenic System - is the world’s first and only self-sustaining cryogenic freezer. The MVE Fusion® can operate as a stand-alone unit, requiring no on-going liquid nitrogen supply or connection to an |

8

| external liquid nitrogen source. Fusion® cryogenic freezers are a perfect solution for remote geographic locations, isolated laboratories, high elevation facilities, or facilities without existing liquid nitrogen infrastructure. |

| ● | MVE Biological Solutions’ Vario® Cryogenic System – is an innovative cryogenic freezer system that can support temperatures anywhere between -20°C and -150°C. In addition to providing greater flexibility, the Vario® series of cryogenic freezer systems provide effective and consistent temperature profiles with less than 1% of the power consumption and a 70% reduction in overall operating cost savings compared to traditional mechanical freezers. |

Competitive Advantages

With our first-to-market integrated platform of technology-driven supply chain solutions serving the life sciences industry, we have established a substantial lead over potential competitors by focusing on de-risking critical processes central to the manufacture of cell and gene therapies. Working with our in-depth knowledge of information technology, cryopreservation, packaging, temperature-controlled logistics, bioservices, and cryogenic systems, our management, technical, business development and service support teams approach our growing markets with valued insights, adaptability, innovation, creative thinking and a mindset of problem resolution which will provide clients with certainty of performance.

The most common alternatives to Cryoport’s platform of solutions are “older technologies” and/or systems as well as partial, non-integrated and/or non-regulated, non-validated solutions. In fact, a portion of the biopharma market and much of the animal health and reproductive medicine markets still use liquid nitrogen and/or dry ice with no monitoring or ongoing validation processes for equipment and/or procedures. Non-integrated systems with assets and technologies managed by multiple entities introduce gaps in policies, procedures, information, and validation of the supply chain solutions which in turn create inherent and material risks during the biostorage, packaging, fulfillment, information gathering, transport processes and other related activities required to securely deliver biopharma products and services in the life sciences.

Through our experience, we know that supply chain processes can have a large impact on temperature sensitive product/commodity conditions. This is especially important for high value, and, at times, irreplaceable commodities for which we provide products and services, whether in support of research, clinical trials or commercial distribution. We therefore seek to exceed the most demanding standards in the industry, e.g., ISO 13485, ISO 21973, ISO 9001, STA (International Safe Transit Association), IATA (International Air Transport Association), to name a few.

Throughout our company, we have implemented Quality-by-Design processes that allow us to assess internal and in-field events including the impact of packaging and supply chain processes and procedures on the commodity being shipped, and the equipment being used for each individual shipment. With the acquisition of CRYOPDP, Cryoport now has increasing control and accountability around distribution which in turn provides better performance and risk management for our clients and their critical therapies. We have been qualified as a trusted temperature-controlled solutions provider for hundreds of life sciences companies, institutions, and governments. We supported 654 clinical trials in the regenerative medicine space as of December 31, 2022. Cryoport and CRYOPDP have logged over 500,000 shipments to over 100 countries with hundreds of different types of life sciences materials in the last 12 months.

Cryoport Systems’ Cryoportal® Logistics Management System (Cryoportal®) is an important backbone technology that is integrated with our partners, such as FedEx, UPS, DHL, Be-The-Match Biotherapies, Lonza, and others. The Cryoportal® Logistics Management System handles order entry, keeps track of our global inventory, and provides algorithms for predictive analysis on every shipment while in transit, globally. Cryoport Systems’ customer service team monitors every in-transit shipment 24/7/365 and, by leveraging the Cryoportal®, they have the unique ability to see issues that arise and take corrective measures up to and including intervention to potentially save a shipment in trouble.

Embedded within the Cryoportal® is our Chain of Compliance®, which is important for regulatory reasons and risk mitigation to our processes. Each of our reusable products, including every Cryoport Express® and ELITE™ shipper and every SmartPak® Condition Monitoring System, has a unique ID attached for its entire life. Thereby, Cryoport personnel can pull any Cryoport shipper out of our fleet and provide customers and/or regulatory agencies with its (and all its components) entire history including every journey it has taken, for whom it was shipped, the contents shipped, the Cryoport shipper’s performance during transit, and the time of its return to a Cryoport Systems’ Global Logistics facility. It also provides technician log information on the validated cleaning process, recertification process of the unit and its components, and recalibration of the SmartPak® Condition Monitoring System as being acceptable for its next use. All this traceability is securely stored in our Cryoportal® Logistics Management System for our clients to access at any time. We believe that this represents a significant differentiator for Cryoport in the markets it serves.

9

The acquisition of CRYOPDP in 2020 significantly expanded Cryoport’s global logistics network through its current 27 offices/logistics centers in 15 countries. During 2022, it further expanded both organically as well as through further development of locations in India and the acquisitions in Ireland, Belgium, Spain and Australia. CRYOPDP has more than 25 years of experience serving the life sciences industry as a specialty courier with innovative and dependable temperature-controlled logistics solutions focused on the pharma/biopharma market.

The acquisition of MVE Biological Solutions in 2020 enabled Cryoport to become the leading global provider of cryogenic systems and solutions. MVE Biological Solutions’ is a leader in the supply of cryogenic systems globally and it is an important part of our global supply chain platform. With its long history of producing the highest quality, most dependable products in the industry, it has set the standard for the manufacture of cryogenic systems including vacuum insulated products, freezer, and shipper solutions used for storage and/or distribution of critical biological material for almost 60 years. MVE Biological Solutions’ equipment is used extensively throughout the life sciences industry and is known for providing the trusted cryogenic storage and/or transportation solutions within the pharma/biopharma, animal health and reproductive medicine markets.

Segment Reporting

The Company continually monitors and reviews its segment reporting structure in accordance with authoritative guidance to determine whether any changes have occurred that would impact its reportable operating segments. Operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing operating performance. The chief operating decision maker (“CODM”) is our Chief Executive Officer. Up until the fourth quarter of 2020, we managed, reported and evaluated our business in the following two reportable operating segments: Global Logistics Solutions and Global Bioservices. During the fourth quarter of 2020, our CODM changed how he makes operating decisions, assesses the performance of the business and allocates resources in a manner that caused our operating segments to change as a result of the MVE Biological Solutions and CRYOPDP acquisitions. In consideration of Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”), Segment Reporting, we determined that we are not organized around specific products and services, geographic regions, or regulatory environments. Accordingly, beginning with the fourth quarter of 2020, we realigned our reporting structure, resulting in a single reportable segment. The Company has adjusted its financial statements for historical periods to reflect this change in segment reporting and show its financial results without segments for all periods presented. See Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Form 10-K for further discussion.

Customers and Distribution

As a result of growing globalization in cell and gene therapy (regenerative medicine), biologics, biopharma, biotechnology, clinical trials, distribution of biopharmaceutical products, animal health and reproductive medicine, the requirement for effective and reliable solutions for keeping clinical samples, pharmaceutical products and other specimen at controlled temperatures requires more sophisticated supply chain solutions in areas such as distribution, complex shipping routes, extended shipping times, potential custom delays, general logistics challenges, biostorage, etc. We believe that our platform of temperature-controlled supply chain solutions, expertise, and geographic footprint enables us to take advantage of the growing demand for effective and efficient global transport and biostorage of temperature sensitive life sciences commodities. This is especially the case for the new therapies being developed in the regenerative medicine market, such as autologous and allogeneic CAR T-cell therapies, that require tightly controlled temperatures through the development, biostorage, transportation, and delivery processes to maintain efficacy and safety.

During the years ended December 31, 2022, 2021 and 2020, no single customer accounted for over 10% of our total revenues.

Our geographical revenues, by origin, for the years ended December 31, 2022, 2021 and 2020, were as follows:

|

2022 |

|

2021 |

|

2020 |

|

|

Americas |

|

54.0 |

% |

54.0 |

% |

63.0 |

% |

Europe, the Middle East and Africa (EMEA) |

|

28.2 |

% |

26.7 |

% |

25.8 |

% |

Asia Pacific (APAC) |

|

17.8 |

% |

19.3 |

% |

11.2 |

% |

10

Customer types

Our major customer types include:

Clinical Trials - Every pharmaceutical or biopharma company developing a new drug or therapy must seek development protocol approval by regulatory bodies, e.g., the FDA or EMA. Usually, these agencies require clinical trials to be designed to test the safety and efficacy of the potential new drug or therapy among other things. Importantly, clinical trial specimens are often irreplaceable because each one represents clinical data at a prescribed point in time, in a series of specimens on a given patient, who may be participating in a trial for up to several years. Sample integrity and information gathering during the transportation and biostorage process is vital to retaining patients in each trial and staying on schedule.

Biotechnology and Diagnostic Companies - The biotechnology market includes basic and applied research and development in diverse areas such as stem cells, gene therapy, DNA tumor vaccines, tissue engineering, genomics, blood products, etc. Companies participating in the foregoing fields rely on temperature-controlled storage and transport of specimens in connection with their research and development efforts, for which our suite of global temperature-controlled supply chain solutions are ideally suited.

Cell Therapy Companies - Rapid advancements are underway in the research and development of cell-based therapies, which involve cellular material being infused into a patient. In allogeneic cell therapies, the donor is a different person than the recipient of the cells. Autologous cell therapy is a personalized therapeutic intervention that uses an individual’s cells, which are cultured and expanded outside the body, and reintroduced into the individual. Once cells are manufactured into a cellular therapy, in either case, they must be stored and shipped cryogenically for which our Cryoport Express® and Cryoport ELITE™ Shipper solutions, CRYOPDP logistics solutions, CRYOGENE’s biostorage capabilities, and MVE Biological Solutions’ cryogenic systems are ideally suited.

Contract Research, Development & Manufacturing Companies - Increasingly, as evidenced by our strategic partnership with Lonza, CRO’s and Contract Development and Manufacturing Organizations (“CDMOs”) are engaging our services exclusively in conjunction with their contract services platform to provide a higher level of service to our mutual client base. We anticipate that these relationships, which are mutually beneficial to both parties as well as our client base, will accelerate and expand to include our entire portfolio of services as cell and gene therapy clinical trials advance and as commercial therapies ramp on a global basis.

Central Laboratories - With the increase and globalization of clinical studies and trials, supply chain support has become more complex and ensuring sample integrity has become more challenging. Reliable, specialty courier costs are now consuming an increasing portion of global protocol budgets. Thus, we believe laboratories performing the testing of samples collected during the conduct of these global multi-site studies are looking for cost effective, state-of-the-art temperature-controlled supply chain solutions. CRYOPDP’s services and its global network of logistic centers have successfully supported central laboratories throughout the world for many years.

Fertility Clinics and IVF - Maintaining cryogenic temperatures during shipping and transfer of In Vitro Fertilization (IVF) specimens like eggs, sperm, or embryos is critical for cell integrity to retain viability, stabilize the cells, and ensure reproducible results and successful IVF treatment. We believe that Cryoport Systems solutions for reproductive medicine are very compelling and well received. Additionally, MVE Biological Solutions supplies cryogenic systems to fertility clinics that wish to store and/or ship reproductive materials in their possession

Animal Health Companies - Our focus in Animal Health is supporting protein production. We provide cryogenic storage dewars to bovine breeders for the support of beef and milk production through artificial insemination, on a global basis. We also provide temperature-controlled supply chain services for advanced vaccines, primarily for aviary. MVE Biological Solutions and Cryoport Systems are our primary participants in this market. We also support therapies for companion and recreational animals which include canine and equine, in addition to veterinary laboratories and other animal related reproductive and health areas.

University and Health Center Research Facilities - Research is conducted globally at major universities and health centers and is often done in collaboration with others which requires using Cryoport Express® Shippers, CRYOPDP, and/or CRYOGENE services. Our broad line of products and services provide solutions tailored to these institutions and individual researchers.

11

Sales and Marketing

We serve clients throughout the life sciences industry and our sales and marketing initiatives are global in nature, focusing on addressing each customer’s “pain points” and anticipated needs through best-in-class temperature-controlled supply chain solutions. Our marketing teams design and implement targeted digital campaigns to support our commercial strategy and promote our innovative portfolio of solutions and capabilities. Our marketing initiatives are designed to drive our business development, program management, consulting, other related activities and increase awareness of our advanced temperature-controlled supply chain solutions.

Competition

We believe Cryoport is unique in its offering, and we have not identified any competition that offers solutions that are as comprehensive or as widely proven in the global market as our platform of temperature-controlled supply chain solutions for the life sciences. However, we do have competition from companies that offer products and/or services that could be considered competitive to certain components or elements of our platform of temperature-controlled supply chain solutions, including specialty couriers, such as World Courier Group, Inc., Marken, Biocair and Quick Life Science Group, along with companies that offer products such as Biolife Solutions, Azenta Life Sciences, and IC Biomedical. In addition, life science companies may develop their own in-house temperature-controlled supply chain solutions, systems and procedures to cover their specific needs.

Engineering and Development

Our research, development, and engineering efforts are focused on continually investigating new technologies that can improve our services, improve the features of our products and solutions, and cause us to be most sensitive to market needs.

Cryoport Data Management Systems

SkyTrax™ Condition Monitoring System - SkyTrax™ is a next generation proprietary-designed Condition Monitoring System, custom-built for the cell and gene industry. In addition to being 4G/LTE compliant, cellular network agnostic, with a full sensor array to track location, temperature, humidity, light, shock, orientation, and geofencing, it will have Bluetooth and Wi-Fi capabilities, along with triple data redundancy, a best-in-class battery life, and bi-directional communication providing scannable airway bills, commercial invoices, loading and unloading instructions, security access features, and temperature data via an E-ink screen. It also can be reprogrammable remotely in support of critical in-field logistics needs. SkyTrax™ will be fully integrated into our Cryoport Express® and Cryoport ELITE™ Shipper Systems. The SkyTrax™ Condition Monitoring System is expected to be launched during the second half of 2023.

Cryoportal® 2.0 and UnITy™ - Cryoport Systems’ Cryoportal® 2.0. Logistics Management Platforms is expected to be launched during the second quarter of 2023 and is ISO 21973 compliant as a supply chain management platform. In addition to managing all aspects of a given client shipment, it also manages all elements of the Chain of Compliance™ based aspects of the packaging as well including shipper management, requalification, and processing. Cryoportal® 2.0 is complemented by CRYOPDP’s recently released UnITy™ Transportation Management System. UnITy™ provides functionalities in addition to transport management that include warehousing management, quality management, customer experience portal, mobile apps for track and trace during transport and storage as well as integration with transportation agents and business partners. The combination of these two powerful informatics platforms provides Cryoport clients with a comprehensive status of their clinical or commercial distribution activities, while supporting regulatory requirements and further sets Cryoport apart from competition.

12

Manufacturing and Raw Materials

Manufacturing - We source components for our products from multiple suppliers, including those that manufacture to our engineering specifications, using, in part, proprietary technology and know-how to mitigate supply chain risks. We also use “off-the-shelf” products, which we may modify to meet our requirements. For some components, there are relatively few alternate sources of supply and the establishment of additional or replacement suppliers may or may not be accomplished immediately. When this occurs, we endeavor to mitigate risk by locating an alternative qualified supplier and, as appropriate, increasing our inventory level. Additionally, there continues to be a worldwide shortage of semiconductor, memory and other electronic components affecting many industries. Certain of our MVE Biological Solutions products and our SmartPak system are dependent on some of these electronic components. A continued shortage of electronic components could impact us significantly and could cause us to experience extended lead times and increased prices from our suppliers. For additional information see “Part I, Item 1A—Risk Factors—Risk Related to Our Business—We depend on the availability of certain component products used in our solutions; delays or increased costs in the procurement of components manufactured by third parties could adversely affect our business operations, financial performance and results of operations, and we may experience customer dissatisfaction and harm to our reputation” in this Form 10-K for additional information.

Our vendor/partner relationships allow us to concentrate on further advancing and expanding our platform of systems, products, and solutions for the life sciences to meet the growing and varied demands for validated temperature-controlled solutions in the life sciences industry. We endeavor to keep our supply structure up to date and agile as it provides us the opportunity to rapidly scale to support our client’s commercialization, systems, products, and solutions requirements; however, we are ever mindful of the work we must do to improve our current sourcing and to continue to mitigate risks therein.

Raw Materials - Various raw materials are used in the manufacture of our products and in the development of our technologies. Most raw materials are generally available from several alternate distributors and/or manufacturers. Where we have experienced significant difficulty in obtaining these raw materials, we have established alternative global sources or are working with the existing supplier to overcome its deficiency.

Patents, Copyrights, Trademarks, and Proprietary Rights

To remain competitive, we must develop and maintain protection on the proprietary aspects of our platform of technologies. We rely on a combination of patents, copyrights, trademarks, trade secret laws and confidentiality agreements to protect our intellectual property rights.

We file patent applications to protect innovations arising from our research, development and design. We currently own approximately 60 issued patents and have more than 100 pending patent applications throughout the world. Our patents generally protect certain aspects of our products and related technology. We also own common law and registered trademarks in the U.S. and in certain foreign countries to protect the names of our company, certain products, and key service brands. We own certain copyrights relating to certain aspects of our systems, products and services.

Our success is influenced, in part, by our ability to continue to develop proprietary products and technologies. It is desirable to obtain patent coverage for these products and technologies; however, some are protected as trade secrets. We intend to file trademark and patent applications covering any newly developed products, methods and technologies. However, there can be no guarantee that any of our pending or future filed applications will be issued as patents or registered as trademarks. There can be no guarantee that the various patent and trademark governmental agencies from around the world or some third party will not initiate an interference proceeding involving any of our pending applications or issued patents. Finally, there can be no guarantee that our issued patents or future issued patents, if any, will provide adequate protection from competition.

13

Patents provide some degree of protection for our proprietary technology. However, the pursuit and assertion of patent rights involve complex legal and factual determinations and, therefore, are characterized by significant uncertainty. In addition, the laws governing patent issuance and the scope of patent coverage continue to evolve. Moreover, the patent rights we possess or are pursuing generally cover our technologies to varying degrees. As a result, we cannot ensure that patents will issue from any of our patent applications, or that any of the issued patents will offer meaningful protection. In addition, our issued patents may be successfully challenged, invalidated, circumvented, or rendered unenforceable so that our patent rights may not create an effective barrier to competition. We must also pay maintenance fees at set intervals for our patents to not expire prematurely. The laws of some foreign countries may not protect our proprietary rights to the same extent as the laws of the United States. There can be no assurance that any patents issued to us will provide a legal basis for establishing an exclusive market for our products or provide us with any competitive advantages, or that patents of others will not have an adverse effect on our ability to do business or to continue to use our technologies freely. As with all patents, we may be subject to third parties filing claims that our technologies or products infringe on their intellectual property. We cannot predict whether third parties will assert such claims against us or whether those claims will hurt our business. If we are forced to defend against such claims, regardless of their merit, we may face costly litigation and diversion of management’s attention and resources. As a result of any such disputes, we may have to develop, at a substantial cost, non-infringing technology or enter into licensing agreements. These agreements may be unavailable on terms acceptable to such third parties, or at all, which could seriously harm our business or financial condition.

With respect to our trademarks, we file and pursue trademark registrations on words, symbols, logos, and other source identifiers that clients use to associate our products and services with us. Although our registered trademarks carry a presumption of validity, they can be challenged and possibly invalidated and as such, we cannot guarantee that any trademark registration is infallible.

We also rely on trade secret protection of our intellectual property. We attempt to protect trade secrets by entering into confidentiality agreements with employees, consultants and third parties, although, in the past, we have not always obtained such agreements. It is possible that these agreements may be breached, invalidated, or rendered unenforceable, and if so, our trade secrets could be disclosed to our competitors. Despite the measures we have taken to protect our intellectual property, parties to such agreements may breach confidentiality provisions in our contracts or infringe or misappropriate our patents, copyrights, trademarks, trade secrets and other proprietary rights. In addition, third parties may independently discover or invent competitive technologies, or reverse engineer our trade secrets or other technology. Therefore, the measures we are taking to protect our proprietary technology may not be adequate.

Cryoport’s Quality Assurance and Regulatory Affairs Programs

Cryoport is committed to quality, and this is reflected in all aspects of our global organization. From our innovative design of products and services to our continuous improvement initiatives, Cryoport has implemented comprehensive quality standards that match or exceed the stringent requirements within the markets we serve. Cryoport’s Quality Management Systems have been designed, implemented, and certified to meet ISO 9001:2015 and ISO 13485 standards in key global locations, demonstrating the discipline necessary to maintain a positive compliance profile. With our strong foundation in ISO 9001:2015 and ISO 13485, we leverage industry-specific experience with applicable regulatory requirements, and industry expectations, to create processes and procedures that incorporate strong operational practices of checks with verification. Our Quality Management Systems are designed to ensure proper controls in manufacturing, temperature-controlled supply chain services, logistics, bioprocessing, customer/client education, contracting, processing, shipping and biostorage, accumulation, and communication.

Our Quality Management Systems incorporate notable good practice quality guidelines and regulations (GxP) elements, beyond those stipulated in ISO 9001:2015 and ISO 13485, to ensure our customers are supported in the manner necessary to maintain standards and to secure a positive compliance profile for Cryoport as a supplier and partner. Notable elements include, but are not limited to, Good Documentation Practices, Good Manufacturing Practices, Good Distribution Practices, archival processes and procedures, Supplier Controls, and Corrective Action and Preventive Action (CAPA) procedures, to highlight a few examples.

14

Through procedural requirements, Cryoport provides substantial risk-mitigation strategies throughout its full offering of products, systems, and services to support and maintain customer confidence. Metrics and key performance indicators are accumulated regularly, and are trended to predict, and mitigate, potential risks to operations. Operating and senior management utilized this information to enact decisions regarding procedures, processes, resource allocation, and corrective actions. Quality-driven initiatives are supported throughout our global organization. We are also subject to GMED, which is an international reference body in the certification of health care and medical devices quality management systems under ISO 9001, NF EN, and ISO 13485. As such, we are subject to audits by a Medical Device Single Audit Program (MDSAP) auditing organization. Cryoport’s cryogenic biostorage facilities are routinely inspected by the FDA and The Foundation for the Accreditation of Cellular Therapy (FACT) to confirm regulatory compliance to industry requirements related to drug applications, filings, and maintenance of various cryogenically stored materials.

Government Regulation

Globally, Cryoport is subject to regulations in numerous country jurisdictions and international regulations relating to manufacturing, shipments, customs, import, export, safe working conditions, environmental protection, and disposal of hazardous or potentially hazardous substances. In addition, we must ensure compliance with economic sanctions and/or restrictions on individuals, corporations, or countries, and other government regulations affecting trade that may apply to our international cross border business activities.

The shipping of biologic products, biologic commodities, diagnostic specimens, infectious substances, and dangerous goods, whether via air or ground, falls under the jurisdictions of many country, state, federal, local and international agencies. The quality of the packaging that protects such commodities is critical in determining successful shipping conditions and to ensure a commodity will arrive at its destination in a satisfactory condition. Meeting stringent regulations such as Dangerous Goods Regulations, ISTA, and IATA, as applicable, Cryoport has demonstrated compliance and adhesion to these requirements. Many of the regulations for transporting dangerous goods in the United States are determined by international rules formulated under the auspices of the United Nations. Dangerous goods are typically one-time shipments and are not a part of our routine services. When called upon to ship dangerous goods, Cryoport follows strict and stringent guidelines. International Civil Aviation Organization (“ICAO”) is the United Nations organization that develops regulations (Technical Instructions) for the safe transport of dangerous goods by air. If shipment is by air, compliance with the rules established by the IATA is required. IATA is a trade association made up of airlines and air cargo couriers that publishes annual editions of the IATA Dangerous Goods Regulations. These regulations interpret and add to the ICAO Technical Instructions to reflect industry practices. Additionally, the Centers for Disease Control (“CDC”) has regulations (published in the Code of Federal Regulations) for interstate shipping of specimens.

Our Cryoport Express® and ELITE™ Shippers meet Packing Instructions 602 and 650 and are certified for the shipment of Class 6.2 Dangerous Goods per the requirements of the ICAO Technical Instructions for the Safe Transport of Dangerous Goods by Air and IATA. Our present and planned future versions of the Cryoport SmartPak™ Condition Monitoring Systems will likely be subject to regulation by the Federal Aviation Administration (“FAA”), Federal Communications Commission (“FCC”), FDA, IATA and possibly other agencies which may be difficult to determine on a global basis. Additionally, our Chain of Compliance™ processes comply fully with ISO 21973 guidelines.

Storage of biological materials that are classified as drug products for human therapeutic use (either for investigational use or commercially approved) or materials used in the manufacture of drug products for human therapeutic use, is regulated by the FDA under Title 21 Code of Federal Regulations (“CFR”) part 210 & 211. Facilities must be compliant with current GMP regulations which are enforced by the FDA through registration and audit. When drug products are exported to other countries, biostorage upon receipt must meet relevant local regulations.

Our MVE Biological Solutions cryogenic stainless-steel freezers and aluminum dewars are certified to the Medical Device Directive (MDD) in the EU. Additionally, registrations for import are in place for various countries with these requirements.

For additional information, see “Part I, Item 1A — Risk Factors—Risks Related to Regulatory and Legal Matters” in this Form 10-K.

15

Environmental, Social and Governance (“ESG”) Program

Beginning in 2020 we initiated a formal internal review of our ESG policies, procedures, and performance. Subsequently in February 2021, we publicly disclosed ESG information based on the framework and standards set by the Sustainability Accounting Standards Board (SASB) and the Taskforce on Climate-related Financial Disclosures (TCFD). Building upon our first report, we began with the goal of developing a formal, thoughtful, comprehensive, and right-sized sustainability program that would be used as a foundation for effectively organizing, reporting, and measuring our performance to set ESG goals in the future.

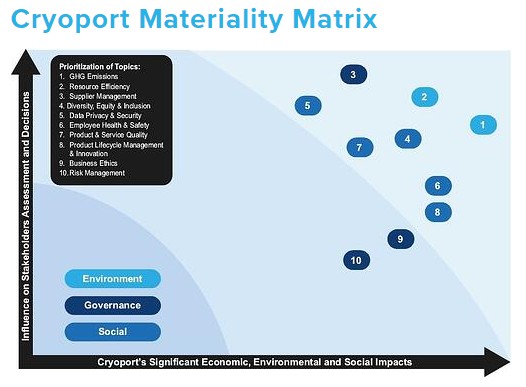

In June 2021, we began a materiality assessment to guide our overall sustainability strategy. The intent of the materiality assessment was to understand what ESG topics were important to our key stakeholders, to take into consideration Cryoport’s business strategy development, and to understand Cryoport’s global internal priorities. There were three key activities for this phase of the process: Benchmarking against peer companies, ratings received from ISS, MSCI, and Sustainalytics, and interviews with key stakeholders.

The information and feedback received from the materiality assessment was aggregated into a customized and weighted materiality matrix. The following Materiality Matrix follows GRI Standards recommendations and plots topics based on their relative priority resulting from the materiality assessment.

Once the Materiality Matrix was developed, several meetings were conducted internally with our ESG committee and our Board of Directors’ Nomination and Governance Committee to evaluate the findings.

As we proceeded on our ESG endeavor in 2022, our initial key focus was on Green House Gas (GHG) Emissions. GHG emissions were the foremost priority identified in our Materiality Matrix and represent a clear global significance for companies, consumers, and other stakeholders.

Cryoport engaged an ESG advisor upon completion of our Sustainability Strategy to assist in creating a report of our estimated global GHG emissions during 2021. The following summarizes that report.

16

Summary of our 2021 GHG Emissions Report

Methodology

We used the World Resource Institute’s Greenhouse Gas Protocol - Corporate Accounting and Reporting Standard (Revised Edition) to calculate the company’s GHG emissions. The standard provides accounting tools to measure, manage, and report on GHG emissions. This protocol classifies emissions into three “scopes.” Scope 1 emissions includes direct GHG emissions, which occur from sources that are owned or controlled by a company. Scope 2 emissions include indirect GHG emission from purchased electricity. Scope 3 emissions include all other indirect GHG emissions.

Organizational Boundary

The reporting boundary for the purposes of the report is Cryoport, Inc. and its consolidated subsidiaries, which includes our four business units (MVE, Cryoport Systems, CRYOPDP and Cryogene) that was comprised of 41 facility locations across 13 countries (United States, China, Netherlands, Portugal, France, Belgium, United Kingdom, Poland, Germany, Singapore, India, South Korea, Australia) in 2021.

Scope

The scope of the report includes our Scope 1 emissions (Direct) and Scope 2 emissions (Indirect emissions from purchased electricity), but generally excludes Scope 3 emissions (Other indirect emissions). However, we did quantify Scope 3 emissions from business travel for three business units and waste for two business units because the data was readily available to quantify such emissions. The following sources of emissions were included in the scope of the report for the identified business units:

Emission Type |

Business Units |

Source of Information |

|

Scope 1 |

Stationary Combustion |

MVE, Cryoport Systems, Cryogene, CRYOPDP |

Actual natural gas consumption or spend data at the majority of locations |

Scope 1 |

Mobile Sources |

MVE, Cryoport Systems, Cryogene, CRYOPDP |

Vehicle fleet information (e.g., make model, year), as well as vehicle mileages or fuel usage data |

Scope 1 |

Refrigeration / AC Equipment Use |

MVE, Cryoport Systems, Cryogene, CRYOPDP |

Refrigerant types and recharge amounts |

Scope 2 |

Purchased Electricity (Location-Based) |

MVE, Cryoport Systems, Cryogene, CRYOPDP |

Actual electricity consumption data at the majority of locations |

Scope 3 |

Employee Business Travel |

Cryoport Systems, CRYOPDP |

Personal vehicle, airline, and rail mileages |

Scope 3 |

Waste |

MVE, CRYOPDP |

Type and weight of waste streams |

Some of the Scope 3 emissions that contribute to our global carbon footprint, but for which we determined that data was not reasonably available for us to quantify in this report include, but are not limited to, transportation and distribution provided by third parties in the performance of our services; use and end-of-life treatment of sold products; and purchased goods and services.

17

Assumptions

We used various assumptions to quantify GHG emissions in the report. As with any projections or estimates, actual results or numbers may vary based upon factors such as variations in processes and operations, availability and quality of data, and methodologies used for measurement and estimation. Changes to emission estimates may occur if updated data or emission methodologies become available. The following are some primary assumptions or estimates that we made in the report:

Stationary Combustion – Natural Gas. Natural gas usage for heating was estimated for several company locations based on either (i) square footage using a. US average intensity for offices of 21.3 SCF/ft2, or (ii) spend data and regional utility rates, depending on what information was available.

Purchased Electricity (Location-Based). Electricity usage was estimated for several company locations based on either (i) square footage using a US average intensity for offices of 13.6 kWh/ft2, or (ii) spend data and regional utility rates, depending on what information was available.

Utility Estimations. When there were gaps in electricity or natural gas data, the average of the prior and following months data was used to estimate the missing information.

Results

Our 2021 Total Emissions, as calculated in the report are as follows:

2021 Total Emissions |

||

Emission Type |

(MT CO2-e) |

|

Scope 1 |

Stationary Combustion |

447 |

Scope 1 |

Mobile Sources |

2,016 |

Scope 1 |

Refrigeration / AC Equipment |

150 |

Scope 2 |

Purchased Electricity (Location-Based) |

6,988 |

Total Scope 1 + 2 |

9,602 MT CO2-e |

|

Scope 3 |

Employee Business Travel |

32 |

Scope 3 |

Waste |

110 |

Total Scope 1, 2, and 3 |

9,744 MT CO2-e |

|

18

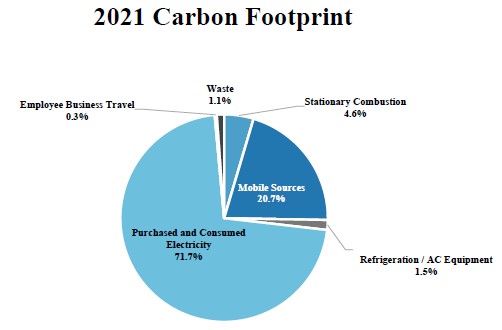

The following chart shows the percent of total emissions in 2021 that was contributed by each type of emission quantified in the report:

2021 Carbon Footprint Intensities

The following table shows our 2021 carbon footprint intensity in relation to square feet of our facilities, revenue, and employees.

Total Scope 1 + 2 Emissions |

9,602 MT CO2-e |

Intensity by Square Footage |

|

Total Facility Square Footage |

555,732 ft2 |

Emissions per Square Foot |

0.01728 MT CO2-e / ft2 |

Intensity by Employee |

|

Number of Employees |

795 |

Emissions per Employee |

12.08 MT CO2-e / employee |

Intensity by Revenue |

|

Total Revenue |

$223 million |

Emissions per $ million Revenue |

43.13 MT CO2-e / $ million |

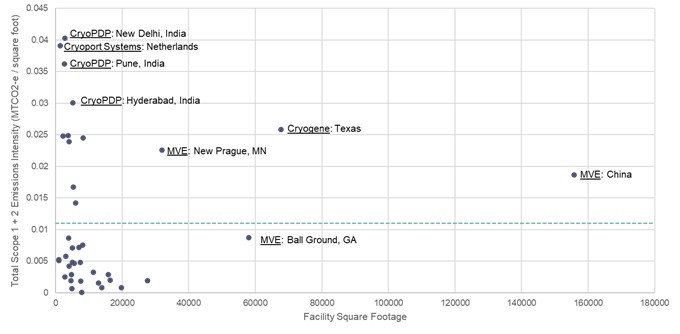

The following chart shows the intensity of 2021 emissions from stationary combustion and purchased electricity by square foot on for each facility. The average facility intensity was 0.0115 MT CO2–e per square foot, as indicated by the dashed horizontal line within the following chart.

19

Intensity of GHG From Statutory Combustion and Purchased Electricity by Facility Square Footage

Next Steps

Using the 2021 carbon footprint as a baseline, Cryoport plans to calculate an annual carbon footprint. Conducting an annual carbon footprint not only allows Cryoport to track changes (i.e., increases or reductions in emissions, fuel usage, or energy usage by facility), but will also be helpful in ultimately setting emission reduction targets.

We are also considering focusing on another topic within our materiality matrix (e.g., resource efficiency) to further the company’s ESG journey.

Supporting Our People (end of December 31, 2022)

| ● | Total Headcount: 1,024 (Full-Time 960, Part-Time 8, Contingent 56) |

| ● | Languages Spoken: 18 |

| ● | Countries: 17 |

| ● | Average Years of Service: 5.32 Years |

Cryoport’s global team of employees are our most valuable resource, from our teams on the front line in our global supply chain and logistics centers, to our manufacturing operations, to our business development personnel, to the engineers who design our products and services, to our quality assurance and regulatory teams that assure the safety, quality, compliance, and integrity of our products.

Our success depends on the health, talent, and dedication of our global team. As we grow our team, we strive to retain, develop, and provide advancement opportunities for our employees. We endeavor to make Cryoport a superior growth workplace with a diverse, inclusive, and equitable environment where all team members have the opportunity to flourish.

20

Diversity, Equity & Inclusion (DEI)

We are committed to inclusion, equity, and diverse representation for our employees across our Company. Cryoport is an Equal Employment Opportunity employer and currently tracks gender distribution across its operations and management. We maintain clear policies related to anti-harassment, discrimination, and retaliation, and provide an anonymous, third party-managed reporting hotline for employees to report incidents of harassment, discrimination, and policy violations. We provide annual online corporate training programs on harassment, diversity and inclusion, business ethics and code of conduct. In addition, Cryoport’s recruiting programs include targeted outreach to a variety of under-represented constituents, including minorities, women, veterans, and disabled populations to help improve recruiting efforts while gaining valuable insights from a diverse set of recruits. Cryoport has partnered with or targeted organizations like Hire Heroes, Career OneStop, recruiting at Historical Black Colleges, Accounting and Financial Women’s Alliance, and Women in Technology.

HR departments in each Cryoport business unit manage HR priorities, including team member career development, engagement, and health and wellness. Our Corporate HR department promotes consistency of policies across operating companies and manages executive development and team member benefits.

Cryoport understands that some of the industries in which we operate, including manufacturing , are typically male-dominated. As of December 2022, women represented a total of approximately 31% of all employees, 27% of all managers, 37% of all directors, and 17% of all senior leadership positions (Vice President and above). Cryoport understands that there is work to be done to create a more equitable and representative senior leadership team and continue to push gender diversity throughout its operations.

We are committed to offering competitive compensation that accounts for geography, industry, experience, and performance. Our compensation programs and practices are designed to attract new employees, motivate, and reward performance, drive growth and support retention. Compensation at Cryoport includes base wages and generally includes an incentive opportunity through cash bonus, equity stock options and/or restricted stock units. More than 99% of our employees participate in our incentive programs.

Employee Health & Safety

Safety is a priority in every aspect of our business. Across our companies, we are committed to making our workplaces and communities safer for our employees, customers, and the public. Our corporate philosophy is embedded in our day-to-day work through rigorous policies and continual education.

Cryoport’s Employee Health & Safety (EHS) programs have resulted in strong safety performance, as demonstrated by our total injury rate (TIR) and lost time injury rate (LTIR) being significantly lower than the global industry averages. Facilitated by our culture of continuous improvement, we are committed to continue to work toward reducing our TIR and LTIR numbers even further.

To understand and improve our safety performance, we evaluate our operational performance across a variety of indicators—including lost-time-injury rate (LTIR)—on a daily basis. In FY22, our LTIR was 1.23, a decrease of 47.7% compared to FY21. In addition to looking at lagging indicators of safety performance, we frequently evaluate the effectiveness of new metrics, including leading indicators, as we strive to improve our safety performance. Cryoport’s operating companies are responsible for implementing policies and procedures aligned with international standards that account for their business and the associated health and safety risks.

We continue to have flexible working arrangements, including telecommuting and part time arrangements, to maintain a safe working environment for our employees throughout the COVID-19 pandemic.

Innovating Responsibility

Cryoport recognizes the role we play in protecting the health and safety of current and future generations through services and solutions that promote sustainability, resilience, and respect for the environment. We strive for a product base that is of the highest quality and with long use phases to minimize impact associated with production of new product, and Cryoport reviews opportunities to eliminate materials of concern and related managed waste streams on a regular cadence.

21

Product & Service Quality

As a temperature-controlled supply chain provider to the life sciences industry, Cryoport must comply with the safe transportation of regulated hazardous materials. As a result, we have designed and developed several features in its various products to comply with US DOT, IATA, ICAO, and other regulatory and guidance bodies. Additionally, safety warnings are included in our product labeling as well as our manuals. Our products are designed to conform to the following standards (where applicable):

| ● | ISO 13485 (Section 7.3 Design and Development, ISO, QMS) |

| ● | ISO 14971 Application of Risk Management, ISO |

| ● | Medical Device Directive Medical Devices Directive 93/42/EEC, and Directive 2007/47/EC amending Council Directive 93/42/EEC concerning medical devices |

| ● | Low Voltage Directive (LVD) (2014/35/EU) |

| ● | Electromagnetic Compatibility Directive (2014/30/EU) |

| ● | RoHS 2 (2011/65/EU) (we are actively working on RoHS 3 and REACH) |

| ● | Safety Requirements For Electrical Equipment For Measurement, Control, And Laboratory Use - Part 1: |

| ● | General Requirements [UL 61010-1:2012 Ed.3+R:29Apr2016] |

| ● | Safety Requirements For Electrical Equipment For Measurement, Control, And Laboratory Use – Part 1: |

| ● | General Requirements (R2017) [CSA C22.2#61010-1-12:2012 Ed.3+U1; U2] |

| ● | IEC 60601-1 - Medical electrical equipment - Part 1: General requirements for basic safety and essential performance |

| ● | IEC 61326-1:2012 - Electrical Equipment For Measurement, Control And Laboratory Use - EMC Requirements - Part 1: General Requirements |

| ● | ASME SEC. VIII Pressure Vessel Code (Fusion Only) |

| ● | EU Pressure Equipment Directive (EU97/23/EC) (Fusion Only) |

| ● | FCC 47 CFR Class B Verification (Fusion Only) |

| ● | IEC 62304 Medical device software — Software life cycle processes |

These standards are woven into our development methodology used to design all new products within the organization. This development process includes a risk management assessment done in accordance with ISO 14971 that identifies hazards and mitigates risks via design improvements, process improvement, and warnings (including labels and safety information shipped with the product).

We pride ourselves on our exceptional operational quality. Our temperature-controlled supply chain solutions focused on cell and gene therapies boast a 95.20% delivery success rate and due to this performance 12,572 additional patients were able to receive therapies over the past 24 months and 1,641 intended parents are potentially able to have successful cycles resulting in the birth of a child on an annual basis because of our CryoStork® solution.

While rare, recalls of product may become necessary. The primary responsibility for recall management lies with our Vice President of Quality Assurance and Regulatory Affairs for manufacturing. The executive staff is involved in decision and implementation processes depending upon the specifics of any recall required. Customer service personnel, sales staff and other resources would then be utilized in reaching all distributors and direct end users. Results of recalls are evaluated daily until the recall is closed. There were no product recalls during 2022.

Product Lifecycle Management